Forex trading, also called international exchange trading or currency trading, could be the worldwide marketplace for getting and offering currencies. It runs 24 hours a day, five days weekly, letting traders to participate on the market from anywhere in the world. The principal aim of forex trading is always to profit from fluctuations in currency exchange prices by speculating on whether a currency couple may rise or drop in value. Members in the forex industry include banks, economic institutions, corporations, governments, and specific traders.

One of the key top features of forex trading is their large liquidity, meaning that big volumes of currency can be bought and sold without somewhat affecting trade rates. This liquidity ensures that traders may enter and quit jobs easily, permitting them to make the most of also little value movements. Furthermore, the forex industry is very accessible, with low barriers to entry, allowing people to start trading with somewhat little amounts of capital.

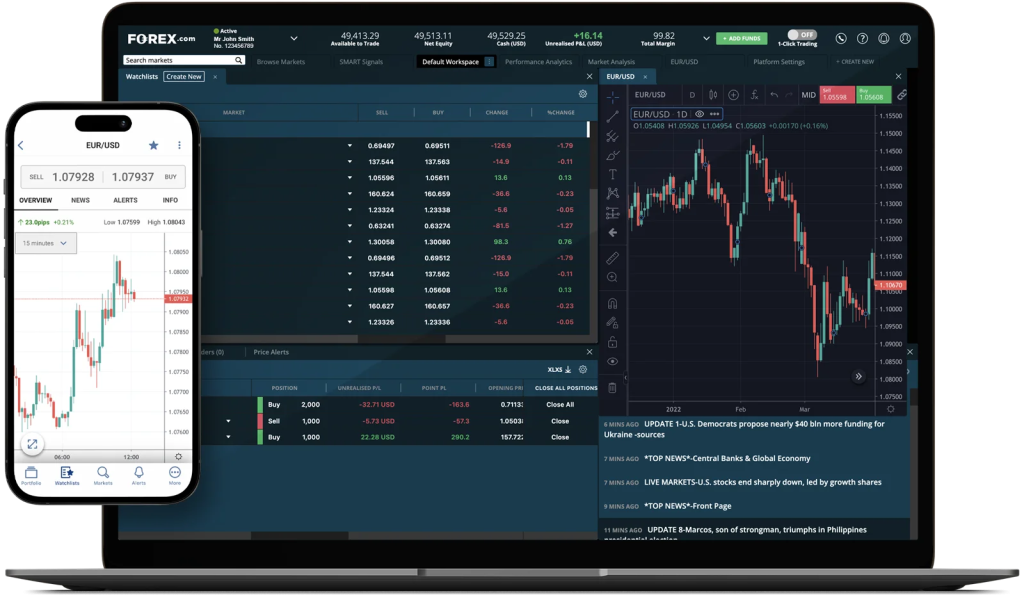

Forex trading provides a wide range of currency pairs to trade, including major sets such as for instance EUR/USD, GBP/USD, and USD/JPY, as well as slight and incredible pairs. Each currency couple presents the exchange rate between two currencies, with the initial currency in the set being the base currency and the 2nd currency being the quote currency. Traders can profit from equally rising and slipping markets by getting long (buy) or short (sell) jobs on currency pairs.

Effective forex trading takes a strong knowledge of fundamental and technical analysis. Fundamental analysis involves analyzing economic signs, such as for instance interest rates, inflation costs, and GDP development, to gauge the main energy of a country’s economy and its currency. Technical analysis, on the other give, requires studying price maps and designs to recognize tendencies and potential trading opportunities.

Chance management can be crucial in forex trading to guard against potential losses. Traders usually use stop-loss requests to restrict their disadvantage risk and employ proper place dimension to make sure that not one trade may somewhat affect their over all trading capital. Furthermore, maintaining a disciplined trading approach and preventing thoughts such as greed and anxiety are critical for long-term success in forex trading.

With the development of engineering, forex trading has be more available than ever before. On line trading platforms and cellular programs provide traders with real-time access to the forex market, allowing them to execute trades, analyze market knowledge, and handle their portfolios from any device. Moreover, the accessibility to academic forex robot sources, including courses, webinars, and demonstration reports, empowers traders to produce their abilities and enhance their trading efficiency around time.

While forex trading presents substantial profit possible, in addition, it carries natural risks, like the potential for substantial losses. Therefore, it is essential for traders to perform thorough study, produce a noise trading technique, and continuously monitor industry situations to produce knowledgeable trading decisions. By staying with disciplined chance management methods and remaining educated about global financial developments, traders may increase their chances of success in the energetic and ever-evolving forex market.